RETURN Project Kicked Off in Reykjavik with Insightful Discussions on Tourism Revenue Transfers

The NPA RETURN project officially launched the 21st of May with a dynamic Kick-Off Event at the NATURA Hotel in Reykjavik, Iceland, bringing together experts, policymakers, and stakeholders to explore the future of Tourism Revenue Transfers (TRTs) and sustainable tourism development across the NPA region.

Welcoming words and the idea of developing the RETURN project

RETURN project manager, Ari Laakso, from the University of Lapland, welcomed the participants to the RETURN kick-off event. He presented the background for the project and how the project was the result of a dialogue between him and Steve Taylor from UHI, in Scotland. In discussions about regenerative tourism, tourism taxes emerged constantly, and after some contemplation, the project was created to address different forms of tourism revenue transfers implemented around the world. The idea is to assist decision-makers within the NPA area in making better tourism strategies that focus on the well-being of the local communities and the environment.

Iceland’s Approach to Tourism Revenue Transfers

The event opened with a keynote by Kolbeinn Árnason, Director General for the Department of Resources, under the Icelandic Ministry of Industries, who introduced Iceland’s evolving tourism taxation system. He outlined the Accommodation Fee, the Infrastructure Fee for cruise ships, and the upcoming Resource Fee for Tourism, a model being applied in fisheries and aquaculture. This fee ensures companies contribute to the sustainable use of Iceland’s natural resources, with 30% of revenues directed to municipalities. Kolbeinn emphasized the potential to link the Resource Fee to visitor access management, sparking valuable discussion on how TRTs can shape future tourism policy. There were still many unanswered questions, and he welcomed the RETURN project for being timely connected to the current development in tourism.

Introducing the RETURN Work Packages

The RETURN project’s three core Work Packages (WPs) were then introduced:

WP1 – Mapping and Evaluating Tourism Revenue Transfer Systems by Hans Welling

WP2 – Adapting TRT Models to National Regulatory Environments by Ragnheiður Bogadóttir

WP3 – Strengthening Community Resilience Through Regenerative Tourism by Aisling Ward

Norwegian and Scottish Perspectives

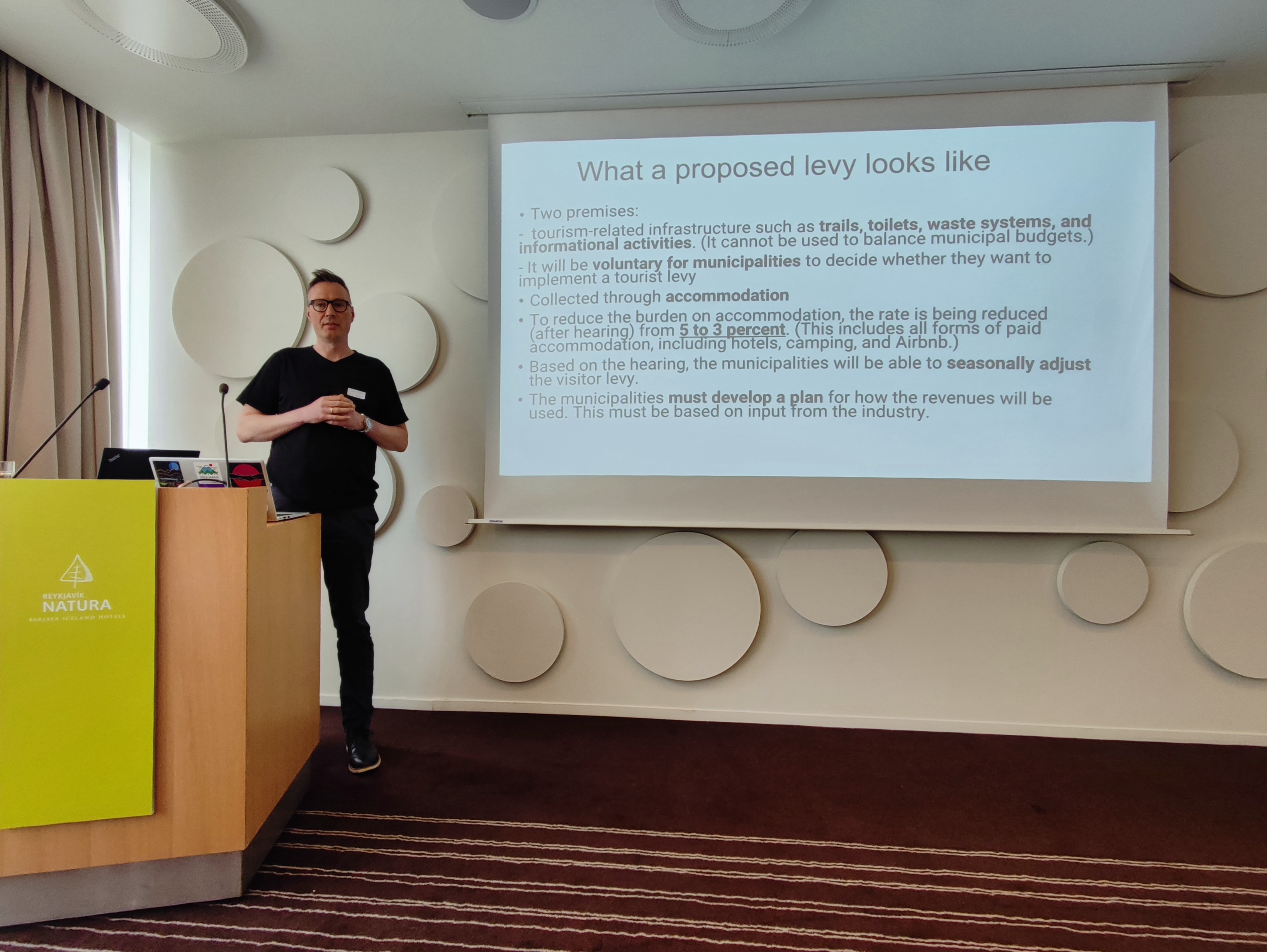

The morning continued with insights from Norway, where Gaute Svensson from UiT and Helga Bårdsdatter Kristiansen from the Municipality of Tromsø, presented national and regional perspectives on the proposed “Besøksbidrag” legislation, currently under review in the Norwegian Parliament (Stortinget). The vote, scheduled for June 4th, could significantly shape how Norway funds tourism infrastructure and environmental protection.

From Scotland, Kendra Turnbull and Steve Taylor shared the experience of implementing the Scottish Visitor Levy, approved in 2024. Their presentation highlighted the planning process, regional adaptations, and the importance of aligning policy with local needs—offering valuable lessons for the RETURN project.

Panel Discussion: Rethinking Tourism Revenue Transfers

The afternoon featured a panel titled “Exploring the Potential of Tourism Revenue Transfers”, with speakers from Greenland, Norway, and Finland:

Niklas Kaskeala (Finland) stressed that TRTs must drive real environmental change, not justify business as usual. He advocated for targeted taxation based on environmental impact, incentives for longer stays, and warned against greenwashing. He also proposed that visitor contributions to restoration projects could build loyalty and support local ecosystems.

Erik Palo Jacobsen (Greenland) emphasized that tourism in Greenland should benefit Greenlandic communities. With the new Nuuk airport and rapid growth, he highlighted a new law requiring two-thirds Greenlandic ownership in tourism companies. TRTs, he noted, could play an important role in supporting local communities and nature, when Greenland is now developing its tourism sector.

Tuomi-Tuulia Ervasti (Norway) underlined the importance of fair distribution of TRT funds. She warned that accommodation-based fees may favor larger cities, leaving surrounding municipalities, where much of the tourism activity occurs, without adequate support. She called for more equitable models that reflect the true impact of tourism across regions.

Icelandic Tourism Industry Perspectives

Jóhannes Þór Skúlason, from the Icelandic Travel Industry Association, delivered a compelling talk titled “Tourism Taxation in Iceland: Striking the Right Balance.” He acknowledged that tourism taxes are already in place, but criticized the political nature of fund redistribution, which often fails to align with national tourism strategies. He described the current system as being hindered by “politicians and political decisions” and likened the process to “a black hole.”

Cruise Sector and Sudden Policy Shifts

Sigurður Jökull Ólafsson from Cruise Iceland presented “Navigating Iceland’s Infrastructure Fee and Its Impact on the Cruise Sector.” He traced the timeline of tax implementation in the cruise industry, many of which were introduced with little notice. While the sector supports taxation, he stressed the need for predictable, long-term planning to avoid uncertainty and resistance.

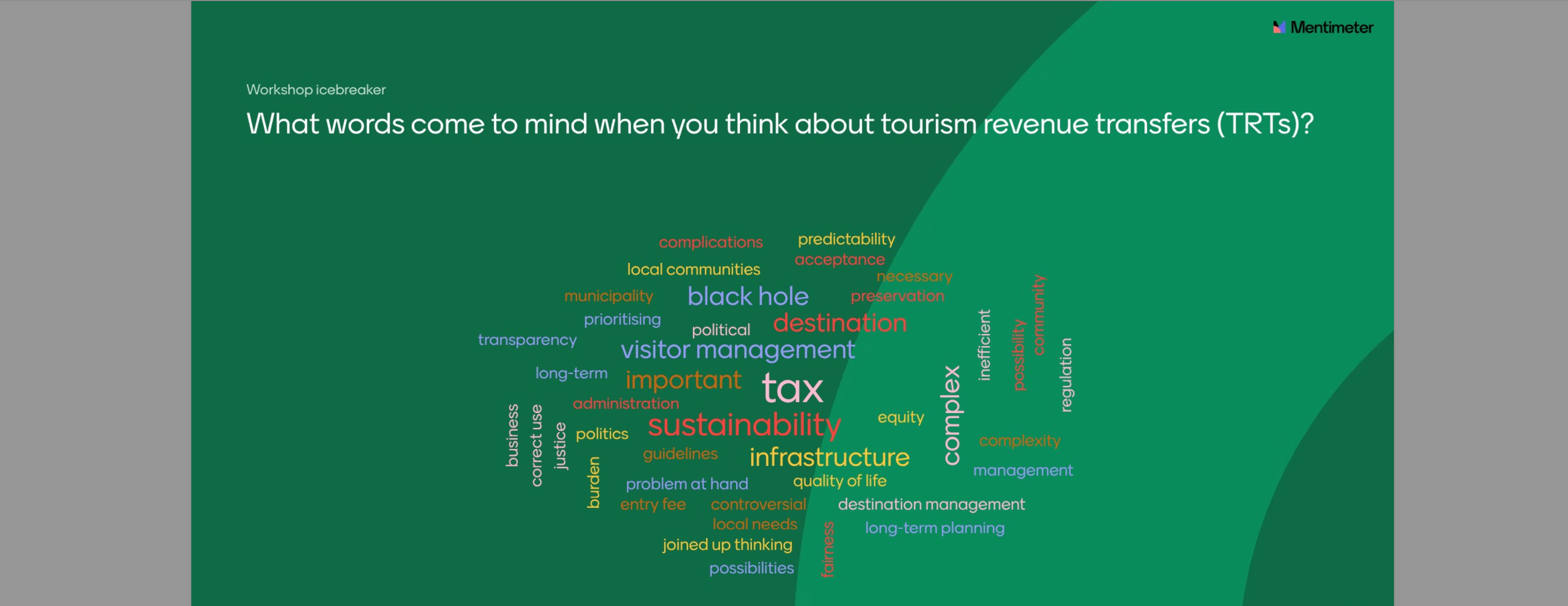

Mentimeter Session

The kick-off event ended with a Mentimeter poll focusing on providing the RETURN project with guidelines for the upcoming activities. The session proved useful, reflecting the presentations given during the day and new perspectives to consider and incorporate regarding tourism revenue transfers (TRTs).

A Platform for Collaboration

The kick-off event ended with a summary of the day, by project manager Ari Laakso. Based on the presentation and the feedback, the RETURN Kick-Off Event set the stage for a collaborative journey toward more equitable, sustainable, and locally grounded tourism revenue systems. With diverse perspectives and shared challenges, the project is well-positioned to shape the future of tourism across the NPA region.